BISP Expand Kafalat Program

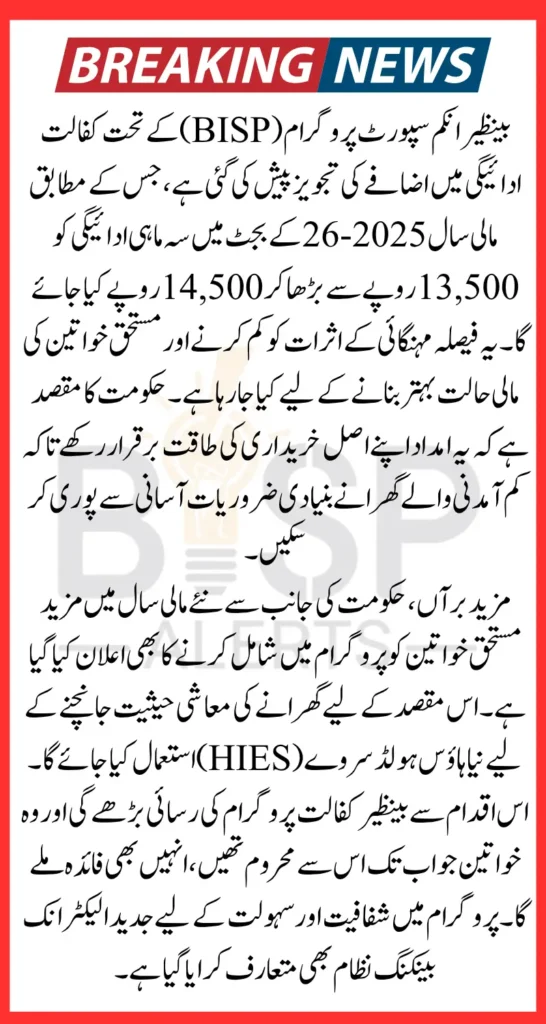

BISP Expand Kafalat Program Government of Pakistan is preparing a new phase of social support under the BISP in the federal budget 2025–26. According to the latest updates, a proposal is under review to raise the quarterly BISP Kafalat payment from Rs13,500 to Rs14,500, starting January 2026. This significant increase is aimed at safeguarding the purchasing power of low-income families affected by rising inflation. Additionally, the government plans to include more eligible women in the program, further expanding its reach and impact across the country.

The BISP payment of 13,500 is being increased and the payment is being increased and in addition, more women will be included in this program. Those who are already included in this program are told that they will get their payment with an increase. Almost many people will be re-included in this program by BISP to eradicate poverty. Those who belong to poor families will see an increase in payment.

The update comes in light of a review report by the International Monetary Fund (IMF), which acknowledged the government’s efforts to uplift poor households through targeted financial assistance. The IMF emphasized the importance of adjusting the Kafalat stipend to keep up with inflation and gradually increasing its generosity compared to international standards.

You Can Also Read: Agosh Program Balance Check 23000 Using PSPA Online Portal

Current Status of the BISP Kafalat Program

The BISP Kafalat Program is Pakistan’s flagship initiative for social protection, providing quarterly unconditional cash transfers UCT to the most vulnerable women. Over the past year, the government raised the quarterly payment from Rs10,500 to Rs13,500 to adjust for inflation and improve support for low-income families. This benefit reaches nearly 10 million families, with 700,000 new beneficiaries added in the current fiscal year.

This program plays a crucial role in helping women cover essential household needs like food, healthcare, and children’s education expenses. The goal has always been to provide financial relief in a way that is simple, transparent, and respectful of dignity.

You Can Also Read: BISP June Payment 8171 SMS Alerts

Proposed Increase to Rs14,500 in Budget 2025–26

The upcoming 2025–26 federal budget includes a proposal to increase the Kafalat quarterly payment by 20%, raising it from Rs13,500 to Rs14,500. This adjustment is expected to come into effect from January 2026, subject to approval.

- Current quarterly stipend: Rs13,500

- Proposed new stipend: Rs14,500

- Expected implementation: End of January 2026

- Reason: Inflation adjustment and improved coverage

This increase is not just about more money; it’s about preserving the real value of the cash assistance amid rising prices. According to the IMF, without inflation-linked updates, the effectiveness of the BISP would decrease over time. Hence, this move is being seen as necessary and timely.

IMF’s Role and Recommendations In BISP

The IMF has closely monitored the performance of Pakistan’s social welfare schemes as part of its support to stabilize the economy. In its recent review, the IMF noted that the BISP budget for 2024–25 is being executed effectively, with noticeable improvements in how cash transfers are delivered. The report urged the continuation of:

- Inflation-adjusted increases in Kafalat benefits

- Further expansion of beneficiary coverage

- Transparent, technology-backed payment systems

It also highlighted the need to raise the generosity level of BISP payments, which refers to the percentage of household consumption supported by the stipend. While the current benefit covers 12.4% of the poorest households’ expenses, international standards suggest this should rise to 15% gradually.

You Can Also Read: BISP June 2025 Payment Check Eligibility Status By CNIC Details

More Women to Be Included in the BISP Kafalat Program

The government also plans to add more deserving women to the program in the 2025–26 fiscal year. The expansion will be based on data from the upcoming Household Integrated Economic Survey HIES which will identify the most vulnerable families across Pakistan.

Benefits of Expanding BISP Coverage:

- Increased access to financial aid for women in remote and underserved areas

- Broader protection for families suffering from inflation and unemployment

- Better social stability and economic inclusion for disadvantaged groups

The goal is not just to increase the number of recipients but to target support more accurately by identifying those most in need. With the help of updated survey data, this expansion is expected to further improve the transparency and fairness of the program.

You Can Also Read: BISP Kafalat June 2025 Eligibility Criteria For Women Who Cannot Receiving Payment

Modernization of the BISP Payment System

A major achievement in recent years has been the upgrading of the BISP payment system. Beneficiaries are now offered full mandate bank accounts and access to a broader range of banks. This shift enables them to:

- Withdraw funds through ATMs and branchless banking

- Exercise more control over their finances

- Enjoy better transparency and reduced fraud risks

This system gives women greater freedom and dignity in managing their financial needs. With digital payment channels, the risk of mismanagement or delay is minimized, and beneficiaries receive timely updates and services.

You Can Also Read: BISP ReSurvey Process Explained Fix Rs. 13,500 Payment

Expected Impacts of the 2025–26 BISP Reforms

If the proposed reforms are implemented as planned, the BISP will become even more effective in reducing poverty and supporting women-led households.

- Increased financial security for 10+ million families

- Higher real value of quarterly cash payments

- Wider inclusion of women from the lowest income groups

- Improved transparency and faster disbursements via digital banking

The program is expected to shift further toward global best practices by ensuring both financial adequacy and system efficiency, with a focus on inclusion, empowerment, and dignity.

You Can Also Read: BISP Payment Expired CNIC Beneficiaries June 2025

Final Words

The proposed increase in the BISP Kafalat quarterly payment to Rs14,500 and the plan to add more women beneficiaries in the 2025–26 budget reflect a strong commitment from the government to protect Pakistan’s most vulnerable citizens. Backed by the IMF’s recommendations and supported by improved digital infrastructure, the future of BISP looks more robust, efficient, and inclusive than ever before.

This development is a beacon of hope for millions of women who rely on this essential support for their families’ survival. As we await the official budget announcement, the message is clear: support for the poor is not just continuing it’s growing stronger.

You Can Also Read: Ehsaas Kafalat Payment Check Through 8171 Portal And SMS

Frequently Asked Questions

1. What is the new proposed BISP Kafalat payment for 2025–26?

The government has proposed increasing the quarterly BISP Kafalat payment from Rs13,500 to Rs14,500. If approved, this increase will take effect from January 2026.

2. Why is the BISP payment being increased?

The increase is meant to adjust for rising inflation and to help poor families maintain their purchasing power. The IMF has also recommended this step to protect the real value of cash assistance.

3. When will the new BISP payment of Rs14,500 start?

If the federal budget 2025–26 is approved, the new quarterly payment of Rs14,500 will start from the end of January 2026.

4. How many families will benefit from BISP in the upcoming year?

Currently, around 10 million families are enrolled in the BISP Kafalat program. The government plans to add more eligible women in the 2025–26 fiscal year.

5. How will new women be selected for the BISP program?

New beneficiaries will be identified based on data from the Household Integrated Economic Survey (HIES). This will help ensure that only the most deserving women are added.

6. What improvements have been made to the BISP payment system?

BISP has modernized its payment model by introducing full mandate bank accounts, allowing beneficiaries to access their funds through ATMs and multiple banks, ensuring faster and more secure payments.